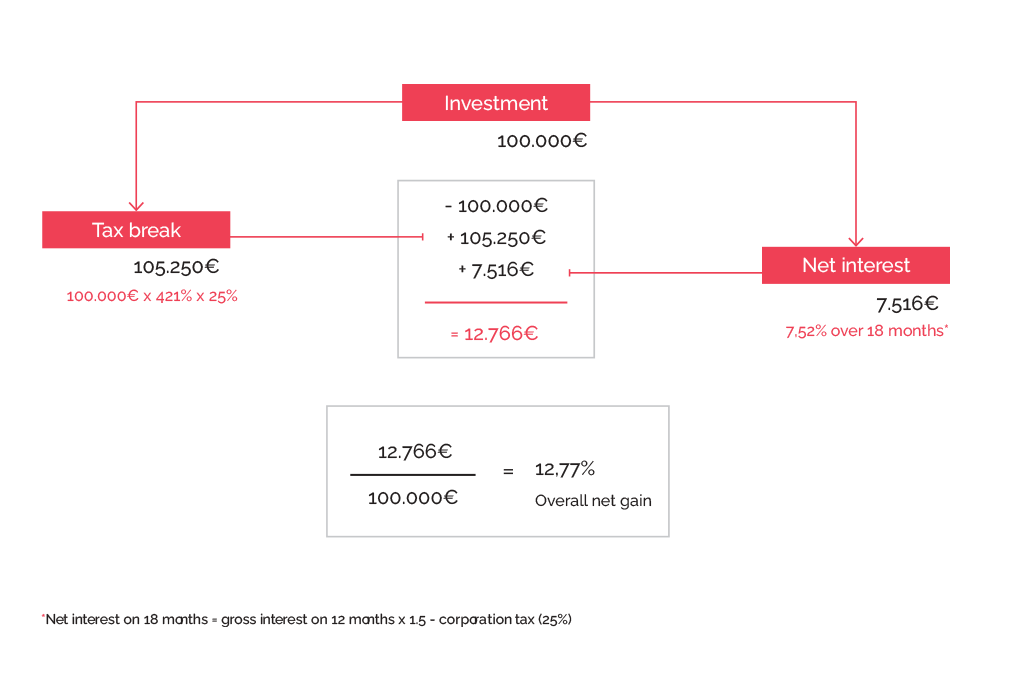

A Tax Shelter investment generates a potential net overall gain of approximately 13% of the invested sum.

Promotional communication

The tax relief, on the one hand, and the additional interest on the investment, on the other, currently offer a potential net overall gain of 12,77% (payments from January 1, 2026) on the amount of the operation. This gain is fixed by law and subject to verification.

For legal entities benefiting from a reduced rate of taxation, the tax gain over the term of the operation may be negative by as much as -15,80%.

For companies that have not made enough advance payments, a Tax Shelter investment at the end of the year can generate an overall net gain of around 20%.

Tax Year 2026

This net overall gain simulation take into account an additional return calculated over the maximum period of 18 months (and subject to corporate income tax at a rate of 25%), and an ordinary marginal tax rate of 25%.

Generally speaking, if an investor is subject to a marginal tax rate that is less than the normal rate, the overall net gain of the operation may be negative by as much as -15.80%. In any event, investors are advised to examine their own specific situation with their usual tax adviser prior to making any investment decision.

For the 2026 tax year, the tax benefit corresponds to 105.25% of the amount of the Tax Shelter transaction based on a standard tax rate of 25%. The amount of the investment is deductible at 421% for your company. In exchange for the investment in the project, the operation generates an immediate provisional tax reduction of 105.25% of the amount of the investment, i.e. the investment x 421% x 25%. This tax reduction immediately generates a gain of 5.25% compared to a non-optimized situation.

The tax relief granted for the year of the Tax Shelter operation is provisional. It only becomes permanent on condition that the company receives its Tax Shelter certificate from the tax authorities for the film project chosen by the investor. This certificate attests to the fact that the film has indeed incurred the minimum amount of production expenditure in Belgium within the periods stipulated by law. SCOPE Invest takes care of obtaining this certification and forwards it to the company that has carried out the Tax Shelter operation.

On top of the tax relief, investors benefit from an additional potential net yield* of 7.52% for the pre-funding of the project in which it’s investing. The amount of the additional yield depends on the EURIBOR* rate applicable at the time of the payment and is calculated over a maximum period of 18 months.

*12-month EURIBOR average from 31 December 2026, valid for all investments paid between 1 January 2026 and 30 June 2026 + 450 base points. Net interest (7.52%) = Gross interest over 18 months (10.02%) – corporation tax (25%). This rate is reviewed at the start of each calendar half-year and is therefore only valid for investments paid up before 1 July 2026.

The recent reform of company taxation has revised corporation tax downwards but more heavily penalises the absence or insufficiency of advance payment. In order to optimise the payment of their tax, it is very much in companies’ interests to combine the Tax Shelter and Advance Payments of tax. And the best strategy in this regard? To estimate, at the start of the year, the amount of tax that will be due during the period and to then make an advance tax payment before the end of the first quarter (A.P.1) while combining it with a Tax Shelter investment.

The combination of an optimized anticipated tax payment before the closing of the 1st quarter with a Tax Shelter investment, which entails a cash outlay in return, can reduce the amount of said optimized anticipated tax payment by about 42% (from 75% to 43.4%), based on the principle that the Tax Shelter reduces the taxable base, and therefore the tax due.

The company can (provisionally) benefit from its tax break from the year of signing of the framework agreement that officialises the Tax Shelter operation. Basically, it reduces its advance payments for the year of the operation by taking into account the tax relief granted.

If the company has already made all of its advance payments at the time of its decision, it will be able to claim reimbursement of the excess tax paid or carry it over to the advance payments for the following financial year.

If it has not made sufficient advance payments for its closed financial year, the tax relief granted (provisionally) via the Tax Shelter operation allows it to avoid part of the increase applicable in the case of insufficient early payments. This situation makes it possible in certain cases to increase the overall net gain of a Tax Shelter operation by up to 20% of the amount invested!