Practical guide to a Tax Shelter investment.

Promotional communication

The law stipulates a maximum sum of €1,000,000 (from tax year 2021) which a company can have tax-exempted each year under a Tax Shelter operation. This also cannot exceed 50% of the estimated movement in reserves for the operation’s financial year.

Based on this maximum level of tax exemption, it is very easy to calculate the sum which can be invested in the Tax Shelter. The exemption rate for a Tax Shelter investment is set by law at 421% starting from the 2021 tax year onward. To exempt the maximum amount of € 1,000,000, it is therefore necessary to invest the sum of € 235,529 (1,000,000 / 4.21).

In most cases, the investment capacity will be equivalent to approximately 9% of the investor’s pre-tax profit.

Amounts allocated to TS investment operations which might not be exempted in the event of any absence or insufficiency of profit can be carried over to the profits for subsequent accounting periods, for a maximum of four years.

The sum invested is used to fund the production of a work (audio-visual or performing arts).

In return, the investor benefits from a potential net overall gain of approximately 13%, via a tax yield and the payment of interest (additional yield) fixed by law.

For legal entities benefiting from a reduced rate of taxation, the fiscal gain over the term of the operation may be negative by as much as -15,80%.

1. Calculation of the sum to be invested

The optimum amount for a Tax Shelter investment can be estimated very rapidly online, or via SCOPE Invest’s calculation tool for a more precise figure.

For legal entities benefiting from a reduced rate of taxation, the fiscal gain over the term of the operation may be negative by as much as -15,80%.

Remember to have your investment project ratified by your usual tax adviser and study the risks associated with the Tax Shelter carefully.

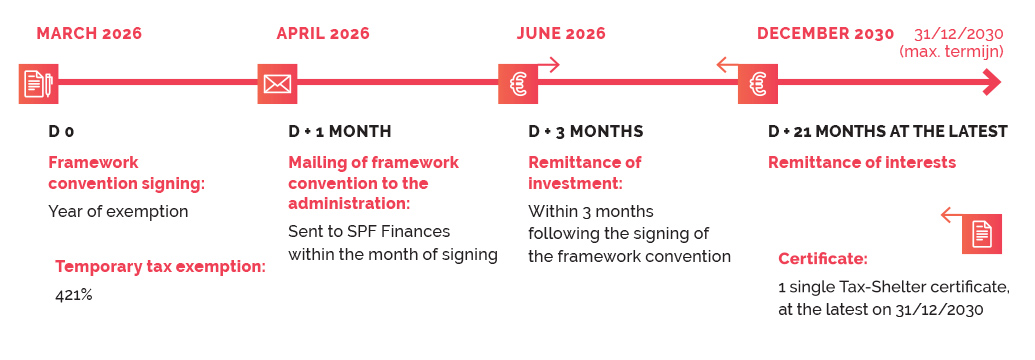

2. Payment to the producer’s account

Once the sum has been defined and the contract signed, specifying the project which will benefit from the investment, the investor has a period of three months in which to make full payment into the producer’s bank account. From this moment on, the investor benefits from the tax relief “on a provisional basis”.

3. Payment of the additional yield

Eighteen months after the date of the payment into the producer’s account, or at the time of issue of the tax certificate when this occurs before the expiry of the eighteen-month period, the producer pays the investor a sum of which the upper limit is fixed by law. Constituting interest for the pre-funding of the project, this gross amount is subject to taxation for the investor.

4. Issue of the tax certificate

This is the final stage and can take place as much as four years (*) after the framework agreement’s signing. After having checked the project’s expenditure and compliance with Tax Shelter legislation, the tax authorities issue a certificate to each investor. This certificate must be attached to their tax declaration and changes the tax relief from “provisional” to “finalised” status.

The issue of this certificate is subject to compliance with the terms of the Tax Shelter legislation.

(*) For projects whose timing of expenditure has been affected by the COVID-19 crisis, this period may run until 31 December of the fifth year after the date of signature of the framework agreement.