Optimize the anticipated payments before the closing of the 1st quarter thanks to Tax Shelter.

The recent reform of company taxation has seen a reduction in corporation tax but also heavier penalisation of any absence of insufficiency of early payment. How best can this be dealt with?

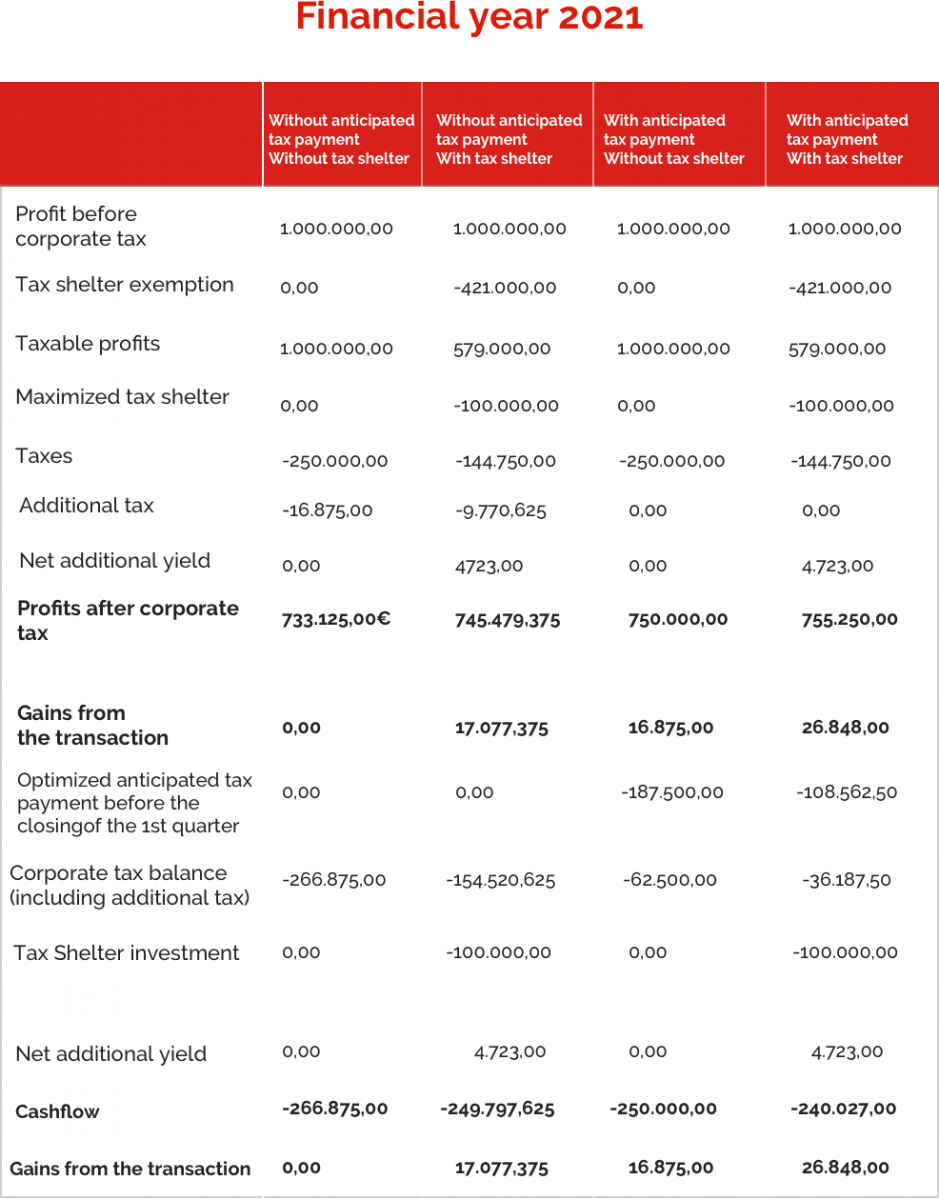

In order to optimise the payment of their tax, it’s in companies’ best interests to combine the Tax Shelter (T.S.) and Advance Payments (A.P.) of tax. And the right strategy in this regard? To estimate at the start of the year the amount of tax which will be due during the period, and then to make an advance tax payment before the end of the first quarter (A.P.1) while combining it with a Tax Shelter investment. Once the amount of corporation tax payable has been optimised, it becomes possible to generate an increase of up to 4.36% in post-tax profit! Read on for a full explanation.

Last update on : 13.05.2020

Companies will effectively pay less tax for the 2019 financial year (33.99% for 2018, 29.58% from 2019 and 25% from 2021), on condition that they use advance payment. Failing that, their tax bill could have a sting in the tail...

Whereas not paying your tax in advance has not previously incurred heavy penalties (an increase of 1.125% applied to the 2017 financial year), the situation has changed considerably in recent months. For the 2018 financial year, the penalty rate has first been doubled (2.25%). And for 2019 (accounts closing dates from 31 December 2018), this rate will again be multiplied by 3. So over a two-year period, not paying your tax early is becoming 6 times more costly, with the penalty rate soaring from 1.125% to 6,75%!

Last update on : 13.05.2020

Fortunately, it’s possible to organise against this hefty increase. How? By precisely calculating the optimum amount of tax to pay early, before the end of the first quarter (A.P.1) so as to benefit from the principle of bonuses linked to early payment. The principle is straightforward: the more a company anticipates the payment of their tax, the greater the bonuses will be.

|

|

A.P. Quarter 1 |

A.P. Quarter 2 |

A.P. Quarter 3 |

A.P. Quarter 4 |

|

2018 - Bonuses |

3% |

2.5% |

2% |

1.5% |

|

2018 - Penalty rate |

2.25% |

|||

|

2021 - Bonuses |

9% |

7.5% |

6% |

4.5% |

|

2021 - Penalty rate |

6.75% |

|||

Optimisation without the T.S: paying an amount equal to 75% of the estimated tax (excluding penalty rate) for the financial year.

As the above table shows, the bonus rate applicable to A.P.1s for the 2019 financial year is fixed at 9%. To optimise your corporation tax, it is therefore advisable to make a sizeable A.P.1. Cancelling out the negative effect of the increased penalty rate (6.75%) requires an A.P.1 to be made for an amount equal to 75% of the estimated tax excluding the penalty rate (6.75/9 = 75%).

Optimisation in combination with the T.S : paying an amount equal to 48.4% of the estimated tax for the financial year.

The combination of an A.P.1 with the Tax Shelter permits optimisation while at the same time reducing the amount of this first advance payment, as the Tax Shelter reduces the taxable base and therefore the tax due. For the 2019 financial year, a coupling operation with a maximum Tax Shelter operation can reduce the optimised A.P.1 by roughly 35%, from 75% without Tax Shelter to 48.4%1 with Tax Shelter. Through this strategy, the A.P.1’s "yield" is increased significantly and the impact on post-corporation tax profit reaches 4.36% net2.

Strategic planning of Tax Shelter investment combined with the A.P.s.

With SCOPE Invest, investors benefit from personalised support and from full management by an experienced tax adviser, who works with them to develop the best strategy for both advance payments and the Tax Shelter.

For legal entities benefiting from a reduced rate of taxation, the overall gain over the term of the operation may be negative by as much as -27.38%.

Investors should examine their own specific situation with their usual tax adviser prior to making any investment decision.

1. This optimisation limit for A.P.1s does not apply to companies which have the capacity to reach the annual Tax Shelter exemption threshold (€850,000 max. and 50% of Taxable Profit Reserves).

2. See the sample calculation for the 2019 financial year.

Last update on : 13.05.2020

Committing to a Tax Shelter operation earlier does not increase the risk. On the contrary, it constitutes a winning strategy. Here’s the proof in five points.

Earliest-possible planning to permit optimisation.

In order to optimise your corporation tax, it’s necessary to combine advance payment and the Tax Shelter. The impact of this winning duo on post-tax profit is substantial: +4.36% net (EI2019). To be able to profit from the high bonuses for the first quarter, the optimisation of your A.P.s needs to be planned at the start of the financial year. So it’s the right moment to estimate your tax and calculate the optimum A.P.1 in combination with a maximum Tax Shelter investment.

Ensuring the availability of a film project.

In view of the current shortage of film projects being funded via the Tax Shelter, it’s important to secure your investment as early as possible. SCOPE therefore recommends that you sign a letter of undertaking during the first quarter, as this guarantees that the investor will be treated as a priority when a film becomes available.

Avoid the uncertainty of the “end-of-year rush”.

For SCOPE, signing up earlier in the year offers greater visibility in terms of the quantity of film projects needing to be found. This helps avoid the “end-of-year rush”) phenomenon, which exerts unnecessary pressure on both SCOPE and investors.

Choosing a film for which the expenses are in progress

By signing up earlier in the year, it may be easier for the investor to be offered a film for which the expenditure is still taking place or is just about to start. This is important as it makes it possible to anticipate payment of the additional return and, in most cases, to shorten the Tax Shelter certification issue period, which is primarily linked to the film’s completion date. Given the Tax Shelter’s high degree of seasonality (most companies close their accounts in December), the producers can use this period to raise funds for films of which the production is due to start sometimes several months later. This delay between sign-up and the start of the film’s expenditure may be shortened by the signing of its framework agreement earlier in the year, as close as possible to the film’s core production period.

SCOPE's commitment.

For the investor, the signing of a simple letter of undertaking at the financial year’s start represents no additional riskl, as SCOPE undertakes to offer the investor a film project before its end, failing which SCOPE will pay the investor compensation equivalent to the potential overall net gain envisaged for the Tax Shelter investment.

Investors should examine their own specific situation with their usual tax adviser prior to making any investment decision.

Last update on : 13.05.2020

Last update on : 13.05.2020