Up to 24% net gain in cases of insufficient advance payments.

The concept of net gain is central to the reasoning behind a Tax Shelter investment.

Viewed from an investor’s perspective, it even constitutes the main reason for opting for this method of reducing a company’s tax burden.

Expressed as a percentage of the sum invested by the investor, the net gain equates to the net profit achieved by the investor compared with the situation if they had simply paid their tax in full.

Traditionally, a distinction is made between the two main components:

The combination of these two elements forms the gross gain.

To establish the net gain, you need to subtract the amount which will be levied by the government as corporation tax from the financial return.

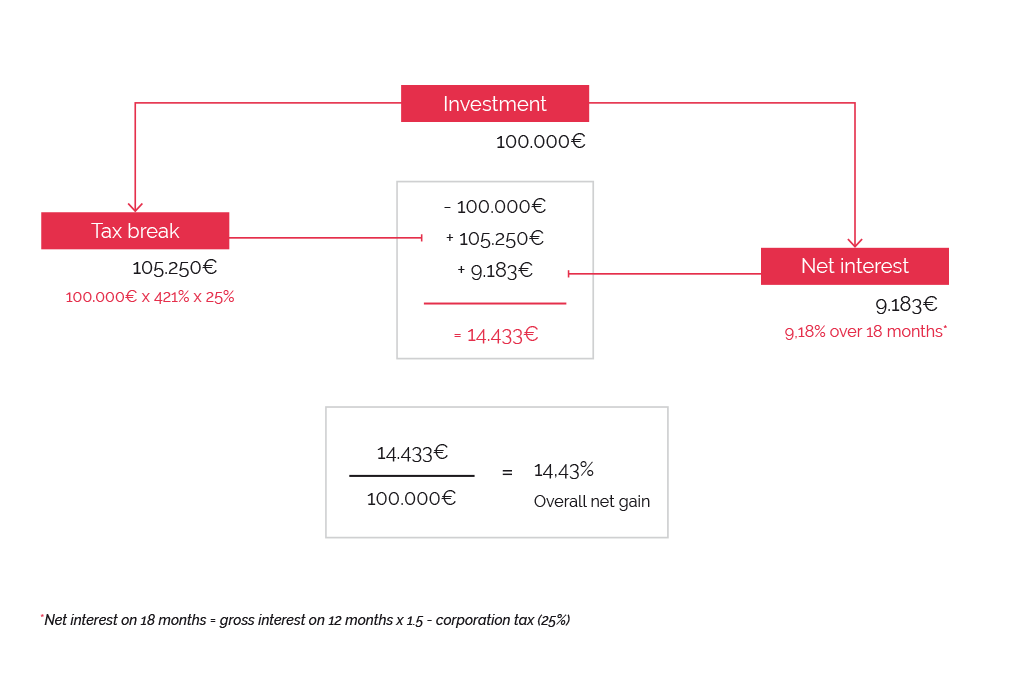

Currently, the net gain from a Tax Shelter investment stands at 14.43%.

Last update on : 20.09.2024

A Tax Shelter operation’s tax yield is returned to the investor in the form of a reduction of their tax bill.

Let’s take a company taxed at the standard rate of 25%.

If it makes a pre-tax profit of €1,000,000 it would have to pay tax of €250,000 to the state.

If it chooses to make a Tax Shelter investment of €100,000, it will be able to make €421,000 fiscally exempt, as the Tax Shelter exemption rate for the 2021 financial year is 421%.

Consequently, its post-Tax Shelter taxable base will be reduced to 1,000,000 – 421,000 = €579,000.

Now let’s calculate the corporation tax on this new amount: 579,000 x 25% = €144,750.

Then we add to this tax the Tax Shelter investment amount paid to the film’s producer: 144,750 + 100,000 = €244,750.

The tax yield from the Tax Shelter operation thus equals 250,000 – 244,750 = €5,250.

Courtesy of the Tax Shelter operation, the investor makes a tax saving of €5,250, or 5.25% of their investment.

Last update on : 20.09.2024

Tax Shelter legislation (Article 194c and following of CIR92) makes provision for the producer to complement the tax yield with the payment, subject to conditions, of an additional financial return.

This does not amount to an obligation for the producer but simply an option for the latter of enhancing the appeal of the Tax Shelter for investors.

All of the intermediaries active on the market currently apply an identical policy, which consists of paying the legal maximum to the investor. So you need to take advantage of this!

In practical terms, the law imposes a maximum rate which is recalculated every 6 months (1st of January and 1st of July) based on the 12-month Euribor rate from the previous half-year.

The financial return period starts from the date of payment of the investment into the producer’s account, and runs until the obtaining of the final tax certificate issued by the SPF Finances, with a maximum of 18 months.

In practice, you should note that in 99.9% of cases, the payment of the financial return takes place after 18 months and therefore before the SPF Finances has issued the final tax certificate permitting the operation to be definitively closed.

Last update on : 20.09.2024

Here we come to a very beneficial part... for companies who find themselves in a situation of insufficient advance payments at the end of the tax year.

For these companies, the Tax Shelter is nothing short of a lifeline. Why?

Not paying your taxes early comes with a cost. Businesses have to pay a penalty at the rate of 6.75% of the tax owed.

Since it reduces the taxable base, the Tax Shelter also reduces the amount of the penalty.

This means it’s highly advantageous for companies to make a Tax Shelter investment if they realise that, at the end of the tax year, they are going to be subject to an increase in their tax bill.

The net gain from a Tax Shelter operation for a company that has made insufficient advance payments can be as much as 16.92%!

|

|

A.P. Quarter 1 |

A.P. Quarter 2 |

A.P. Quarter 3 |

A.P. Quarter 4 |

|

2018 - Bonuses |

3% |

2,5% |

2% |

1,5% |

|

2018 - Penalty rate |

2.25% |

|||

|

2024 - Bonuses |

9% |

7,5% |

6% |

4,5% |

|

2024 - Penalty rate |

6.75% |

|||

|

2025 - Bonuses |

12% |

10% |

8% |

6% |

|

2025 - Penalty rate |

9% |

|||

Last update on : 20.09.2024

Clearly, these theoretical returns are based on an elementary principle: companies need to have profits taxed at a sufficiently high rate for the mechanism to generate a gain for the investor.

Consequently, there is no benefit for companies paying a reduced rate (20%) of tax to carry out a Tax Shelter operation if their taxable base does not exceed €100,000.

This is because the first €100,000 tranche of such companies’ profit is taxed at a rate of 20%, making the Tax Shelter operation unprofitable.

This is a point to watch for smaller companies.

Last update on : 20.09.2024