With a tax increase of 9%, advance payments are more and more popular. But in the final stretch, it's better to opt for a Tax Shelter!

Since the reform of the corporate tax, which manifested itself first during the 2019 tax year and later in 2021 through a significant reduction in the corporate tax rate, now stabilized at 25%, the legislator has tried to rebalance the situation by also considerably increasing the surcharge for the said tax in case of absence or insufficiency of advance payments.

Companies are therefore taxed less (we've moved from 33.99% to 25% in just a few years), provided they pay their taxes in advance.

The surcharge applied for late or insufficient payments is enough to make one think, as it has risen from 2.25% to... 9%!

Let's take a concrete example of a company with a taxable base of €500,000.

Based on a standard tax rate of 25%, it must pay an annual tax of €125,000. To this amount, an additional €11,250 must be added (125,000 * 9%) if the company has made no advance tax payments during the year when profits were earned.

In this case, the annual tax amounts to €136,250, or 27.25%.

Last update on : 06.11.2024

Faced with this situation, accountants are increasingly attentive to advising their clients to make advance payments.

These can also be financed through a bank loan, the interest on which is tax-deductible.

However, when the company finds itself with insufficient advance payments in the last quarter of its fiscal year, the return on each euro paid is lower than that of the penalty (6% reduction vs. 9% surcharge).

Each euro paid into an AP4 thus allows for a reduction in the tax bill but only through a reduction of the penalty, up to a maximum of 6% of the amount paid.

Last update on : 06.11.2024

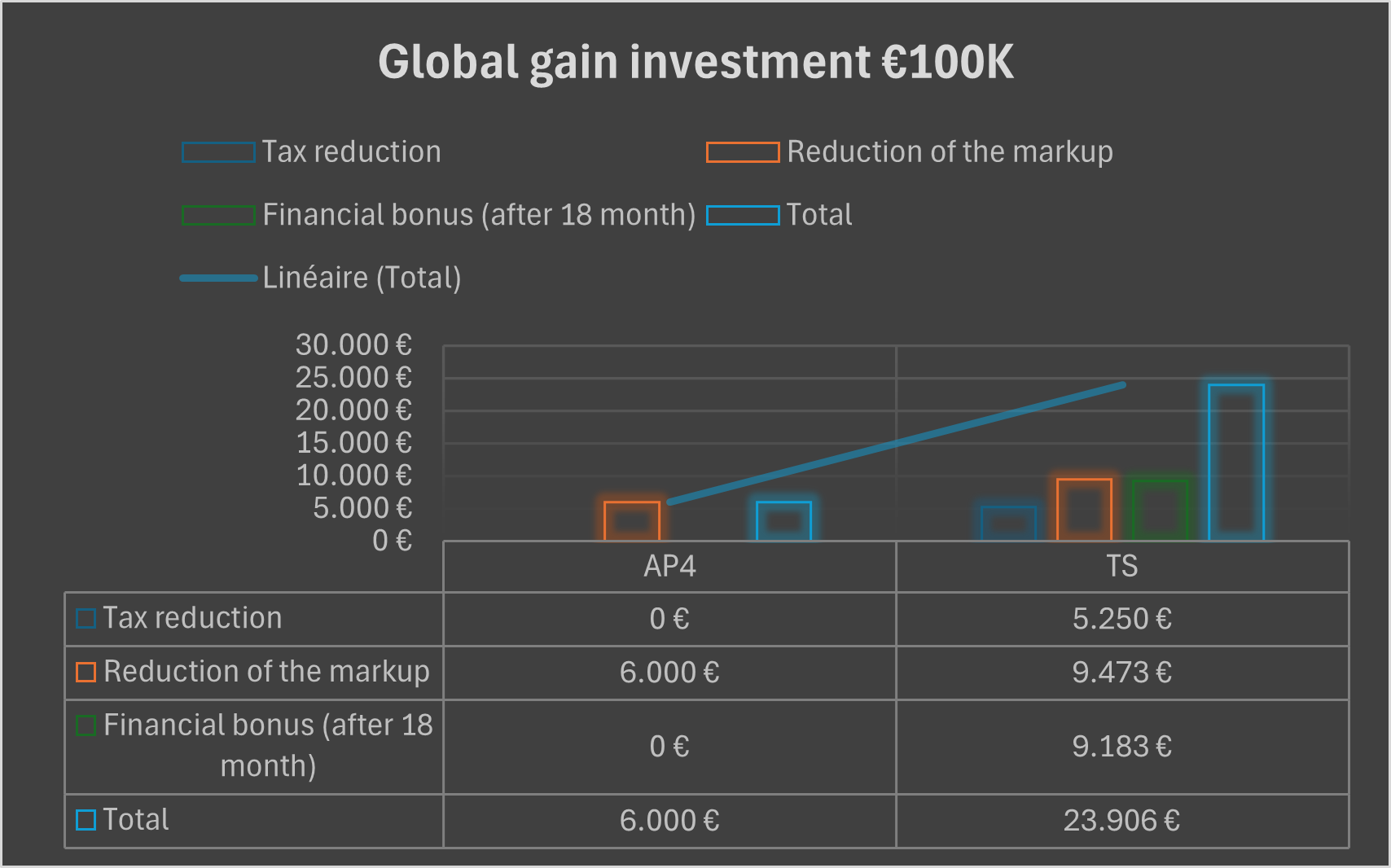

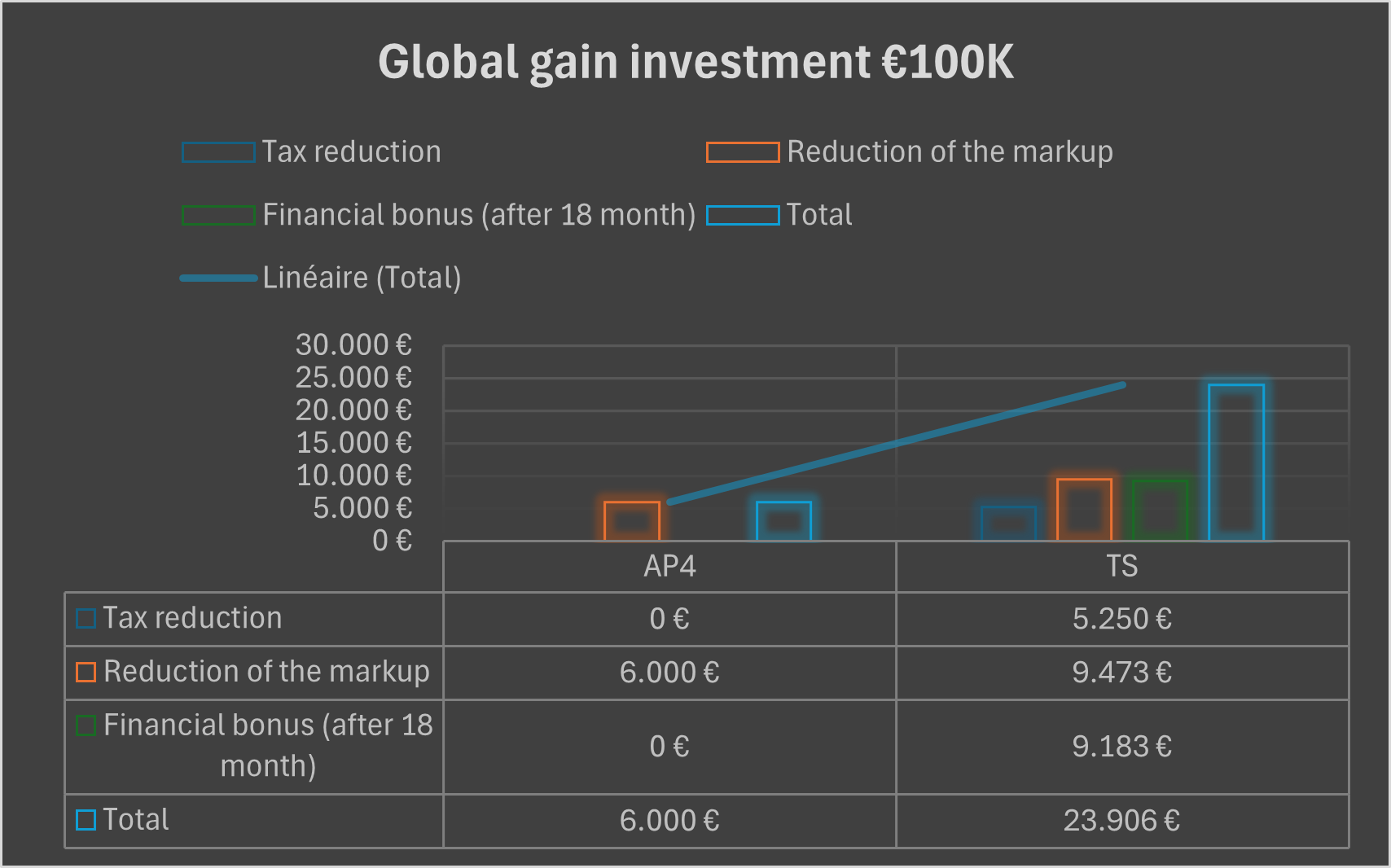

The choice often arises to use the amount intended for the AP4 to invest in a Tax Shelter.

This alternative currently offers a significantly more advantageous return of around 24%!

Indeed, the amount invested in a Tax Shelter instead of the AP4 allows the company to reduce its taxable base and therefore also the amount of the surcharge related to the absence or insufficiency of advance payments, up to 9.47%, which is 3.47% better than the AP4.

Add to that the return of 14.43% from the Tax Shelter, and we reach 23.90%!

Last update on : 06.11.2024

Let's take the example of a company considering an AP4 of €100,000 in December to mitigate the negative effect of the surcharge.

The goal will be achieved with a reduction of €6,000 (6%) of the penalty. If the same company invests this amount of €100,000 in a Tax Shelter, it secures a net gain of €23,905.5 composed as follows:

Last update on : 06.11.2024

Is it now clear? The net return of the Tax Shelter for the investor at this time of year is 4 times higher than that of the AP4!

Last update on : 06.11.2024

In addition, another significant advantage of the Tax Shelter is that it allows a disbursement up to a maximum of 3 months after the date of signing the investment framework agreement.

In practice, investors who sign their Tax Shelter commitment at the end of December have until the end of March to make the payment.

They thus gain this valuable deadline compared to the AP4, for which the payment must be made by December 20 at the latest.

Last update on : 06.11.2024