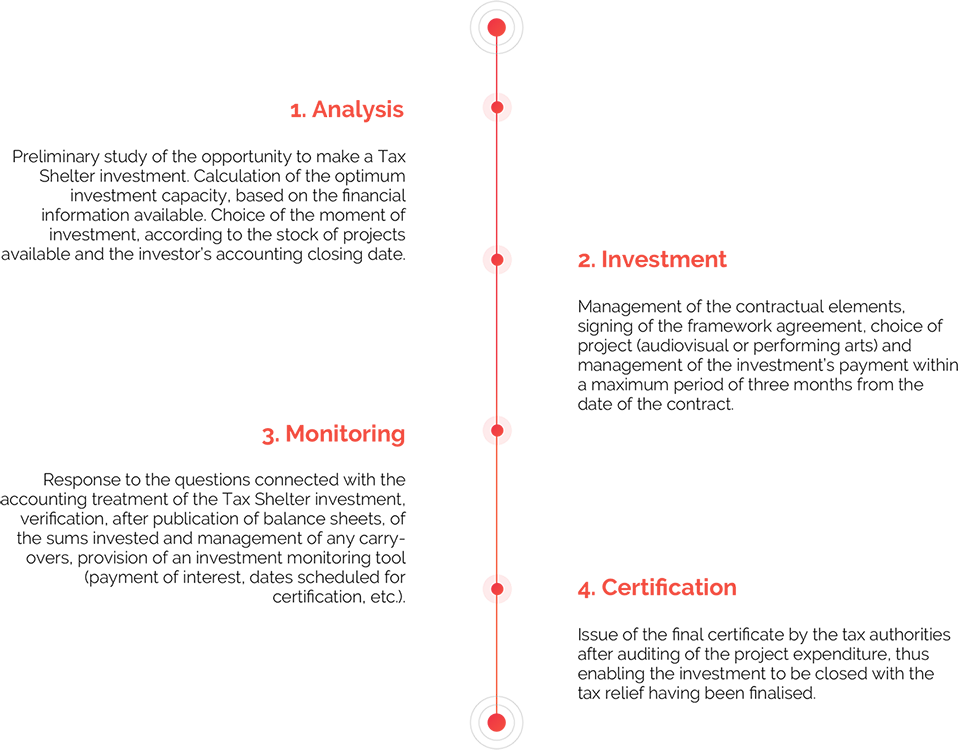

SCOPE Invest supports investors throughout the process of their investment.

From analysis of Tax Shelter investment capacity to the issue of the final tax exemption certificate, after checks conducted by FPS Finance, SCOPE Invest supports investors and their tax advisers and offers them all the advice and tools they need for the effective management of the operation.

While a Tax Shelter investment is not exactly an obstacle course, it makes sense nonetheless to choose a partner with the expertise to avoid certain pitfalls.

Each investor’s specific situation should be examined with the investor’s usual tax adviser prior to any decision to invest.

The issue of this certificate is subject to compliance with the terms of the Tax Shelter legislation and to expenditure control carried out by the Tax Shelter-unit of the FPS Finances.

Investment planning

With SCOPE Invest, investors benefit from personalised support and full management by an experienced Tax Shelter adviser, who provides them with a detailed presentation of the Tax Shelter product developed by SCOPE Invest.

• Each Investor is assigned their own specific Adviser for the full process of their Investment:

- The latter provides them with a detailed presentation of SCOPE Invest’s Tax Shelter product and the film projects available for the period during which they are choosing to invest;

- The adviser answers all their questions (on accounting, taxation, legislation, etc.) and, where necessary, refers them to internal specialists from SCOPE Invest or from external consultancy firms;

- He/She also liaises with their accountant in order to define the optimum investment amount using the simulation tool developed by SCOPE Invest.

• The investor signs up for their Tax Shelter investment directly with their adviser.

• SCOPE Invest informs the Tax Shelter control unit of the investment and invites the investor to make the payment within 3 months of the signing of their framework agreement.

SCOPE Invest has developed a highly effective simulation tool that permits the precise calculation of the optimum amount to be invested in the Tax Shelter, according to the information available at the time of the simulation.

Upon publication by the investor of its annual accounts, Scope Invest validates the amounts invested during the previous financial year and proposes to the investor and/or their tax adviser a plan for a new Tax Shelter investment, taking into account any sums to be carried over from previous financial years.

This proactive monitoring of investors enables the validation of past investments and, if necessary, the refinement of the simulation prior to each investment decision.

In order to facilitate investors’ monitoring of the development of their Tax Shelter investments, SCOPE Invest provides them and their tax advisers with access to a secure web platform where they can monitor the progress of their investment portfolio in real time.

All elements linked to the Tax Shelter operations conducted by SCOPE Invest are accessible around the clock and in real time.

mytaxshelter.be is accessible 24/7 via a username and password available at the investor’s request.